Personal Loans for Emergencies: When and How to Use Wisely

Understanding Financial Emergencies

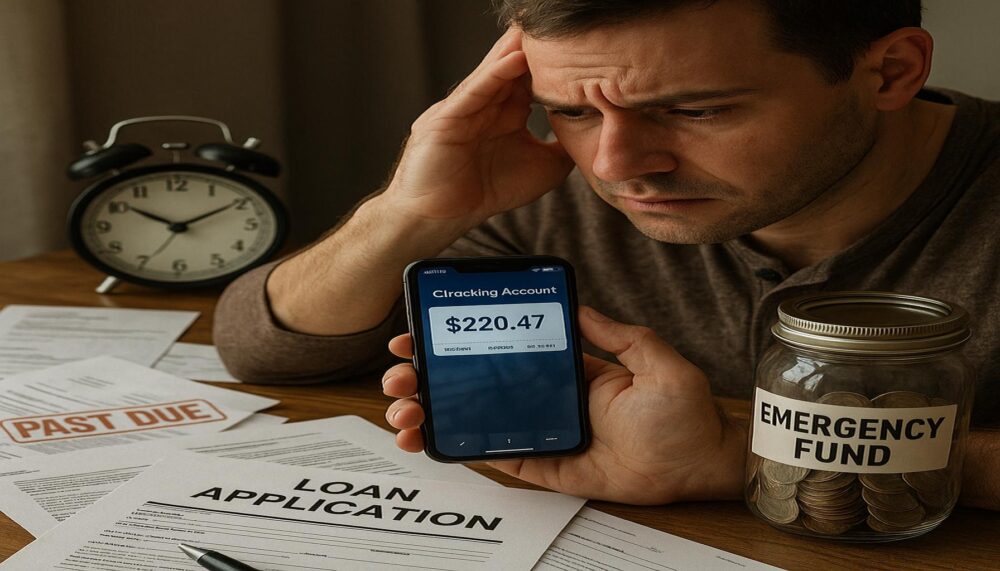

Life is unpredictable, and financial emergencies can often catch us off guard. Experiencing sudden costs can create feelings of anxiety and helplessness, but knowing how to navigate these waters can empower you. A personal loan, when utilized correctly, can not only provide immediate relief but also pave the way for a more secure financial future. It’s crucial to recognize that while loans can serve as a bridge over troubled waters, they also require a thoughtful approach to avoid exacerbating your financial strain.

When to Consider a Personal Loan

The decision to take out a personal loan should be grounded in careful consideration of your specific circumstances. Here are some common scenarios where a personal loan may prove advantageous:

- Medical Expenses: Health emergencies often arrive unannounced. Whether it is a sudden illness or an accident, the costs associated with medical care can accumulate quickly. A personal loan can provide the necessary funds to ensure you receive treatment in a timely manner, which can not only help you recover faster but also prevent further health complications due to delayed care.

- Home Repairs: Our homes are our sanctuaries, but they can also be sites of unexpected challenges, such as a leaky roof or malfunctioning HVAC system. These issues often necessitate immediate attention, as failure to address them can lead to more serious — and expensive — problems down the road. With a personal loan, you can tackle these repairs head-on, safeguarding your property value and comfort.

- Job Loss: Experiencing a job loss can shake your financial foundation. During such turbulent times, having a financial cushion is vital. A personal loan can help cover your essential expenses, such as rent, utilities, and groceries, allowing you to focus on finding new employment without the added pressure of immediate financial obligations.

Prudent Considerations Before Borrowing

Before you decide to take out a personal loan, it’s crucial to equip yourself with the knowledge needed to make responsible decisions. Here are some essential elements to ponder:

- Interest Rates: Not all loans are created equal. Understanding the cost of borrowing is paramount. Take the time to research various lenders, comparing their interest rates and terms. Opting for a loan with a lower interest rate can significantly reduce the total amount you will have to repay.

- Loan Amount: It’s easy to feel tempted to borrow more than you need in a state of urgency. However, being prudent and only borrowing what you truly require can help you avoid further financial burden. Assess your situation realistically and seek only what is essential for your immediate needs.

- Repayment Terms: Understanding the repayment schedule is an integral part of the borrowing process. Clear comprehension of when payments are due and how much is expected can help avoid the pitfalls of missed payments and associated late fees.

Taking Control of Your Financial Journey

By approaching the landscape of personal loans with knowledge and responsibility, you can tackle emergencies head-on without jeopardizing your long-term financial stability. Each decision you make can either strengthen or weaken your financial health. Embrace this opportunity to act judiciously. Understand your situation, weigh your options, and take control confidently of your financial journey. Remember, the goal is not merely to overcome an emergency, but to emerge from it with renewed strength and wisdom.

Evaluating Your Financial Needs

When faced with an emergency, it’s easy to get swept up in the urgency of the moment. However, taking a step back to evaluate your financial needs is fundamental to making a responsible decision about whether to secure a personal loan. Understanding the full scope of your situation will help you avoid unnecessary debt that could linger long after the immediate crisis has passed.

Begin by taking a closer look at your overall financial picture. Assess your current expenses, income stability, and outstanding debts. Ask yourself some critical questions:

- Can I cover this emergency with my savings? Before resorting to a personal loan, evaluate whether you have any savings that could alleviate the situation without incurring debt. While it’s natural to want to preserve your emergency fund, sometimes, using a small portion for an immediate crisis can be wiser than accumulating more debt.

- What are my monthly obligations? Understanding your monthly obligations helps you determine how much you can realistically afford to borrow and still keep up with your regular bills. This awareness will equip you to make informed decisions about whether a loan makes sense in your current financial context.

- How long will it take to repay the loan? A detailed understanding of the loan repayment terms will significantly impact your decision. Calculate how the loan payment will fit into your budget and whether it will strain your finances more than it helps.

This reflection will help ensure that when you take out a personal loan, it is a means to a much-needed end rather than a pathway to further financial distress.

Building a Budget for Your Loan

Before you finalize your loan amount and choose a lender, it’s crucial to develop a comprehensive budget. A well-structured budget allows you to identify exactly how much you can afford to borrow and repay without jeopardizing your essential living expenses. It can calm anxiety by providing clarity in times of financial uncertainty.

Start by outlining your income sources and mapping out your fixed and variable expenses. This will give you a clearer idea of what is non-negotiable and what can be adjusted in times of need. Consider the following:

- Income: Tally your monthly income, including salary, side gigs, and any benefits you receive. Be realistic about your earnings to avoid overestimating your financial capabilities.

- Fixed Expenses: Identify your fixed expenses, such as rent/mortgage, utilities, insurance, and any other bills that you cannot avoid. This will help you set aside the necessary funds to meet these obligations even after borrowing.

- Variable Expenses: Consider any variable costs such as groceries, transportation, and entertainment. Finding ways to reduce discretionary spending can create more breathing room in your budget for monthly loan repayments.

Equipped with this information, you can approach a personal loan with confidence, ensuring that it serves as a constructive financial tool rather than a source of future stress. Remember, the proactive steps you take today can empower you to manage your finances with greater wisdom and resilience in the face of life’s unpredictabilities.

Understanding Loan Options and Terms

Once you’ve evaluated your financial needs and established a budget, the next step is understanding the loan options available to you. With a myriad of lenders, terms, and interest rates, it’s essential to research thoroughly and select the one that aligns with your individual financial situation and repayment capacity.

Start by comparing different lenders. Traditional banks, credit unions, and online lenders each offer unique features and benefits. For instance, credit unions often provide lower interest rates and more personalized service, but they may have stricter membership requirements. On the other hand, online lenders may expedite the application process and offer quick funding, which can be invaluable in an emergency.

Make sure to pay close attention to the interest rates and APR (Annual Percentage Rate). The APR includes not just the interest rate but also any additional fees, giving you a more comprehensive picture of the total cost of the loan. This will help you make a clearer comparison among different options. Even a slight variation in the interest rate can have a significant impact on your overall repayment amount. For example, borrowing $5,000 at an interest rate of 10% versus 15% can result in hundreds of dollars more in interest charges over the life of the loan.

Another important factor to consider is the loan term. This refers to how long you have to repay the loan, typically ranging from a few months to several years. Longer loan terms may lower your monthly payments, but they can also lead to paying significantly more interest over time. Conversely, a shorter loan term will typically mean higher monthly payments but less total interest. Striking the right balance based on your budget is crucial.

Evaluating Potential Fees and Prepayment Penalties

Don’t forget to scrutinize the fees associated with the loan. Lenders may charge application fees, origination fees, or late payment fees that can quickly add up and derail your financial plans. Additionally, it’s critical to understand whether there are prepayment penalties that could deter you from paying off the loan early. If there’s a chance you may be able to repay the loan ahead of schedule, inquire upfront whether the lender allows this without incurring additional costs.

The Impact of Your Credit Score

Your credit score plays a pivotal role in the loan approval process. Higher credit scores often qualify for better interest rates and terms. If your credit is less than stellar, you might be offered higher rates, or even denied entirely. Before applying for a loan, check your credit report to identify any discrepancies or areas you can improve. If your score is low, consider taking steps to enhance it—such as paying down existing debts or making timely payments—before pursuing a loan.

Being informed about the various loan options, terms, and fees allows you to approach personal loans with the discernment they require. By patiently researching and choosing a loan that resonates with your financial goals, you can navigate the complexities of emergency funding without feeling overwhelmed or trapped in a cycle of debt. In moments of uncertainty, knowledge empowers you to turn emergencies into manageable challenges, paving the way for a brighter financial future.

Conclusion

In the unpredictable landscape of life, having a strategy for managing emergencies is crucial, and personal loans can serve as a powerful tool when used wisely. The key lies in educating yourself about the various options available, understanding the terms and conditions associated with each loan, and making decisions grounded in your financial reality. By evaluating potential lenders, comparing interest rates and APR, and determining the best loan term for your situation, you empower yourself to navigate through financial turmoil with confidence.

Remember, it’s not just about obtaining fast cash; it’s about choosing a loan that fits seamlessly into your repayment capability. This means being vigilant about hidden fees, recognizing the importance of your credit score, and considering the implications of prepayment penalties. Taking the time to research and reflect can save you from the pitfalls of high-interest debt that often lead to prolonged financial strain.

Ultimately, utilizing personal loans in times of emergency should be approached with a sense of responsibility and foresight. Embrace this opportunity not just as a band-aid for your immediate needs, but as a stepping stone toward strengthening your overall financial health. By cultivating financial literacy and making informed decisions, you can transform challenging circumstances into moments of growth, ensuring that you emerge from adversity with not just survival, but a roadmap to future success.

Related posts:

The Comprehensive Guide to Getting an Oportun Personal Loan

Ideal Low-Risk Investments for Brazilians in the USA

The Pros and Cons of Personal Loans: What You Need to Know

Strategies for Using Personal Loans in Debt Consolidation

How to Secure a Personal Loan with Wells Fargo: A Comprehensive Guide

How to build credit in the USA using credit cards

Beatriz Johnson is a seasoned financial analyst and writer with a passion for simplifying the complexities of economics and finance. With over a decade of experience in the industry, she specializes in topics like personal finance, investment strategies, and global economic trends. Through her work on Web Dinheiro, Beatriz empowers readers to make informed financial decisions and stay ahead in the ever-changing economic landscape.