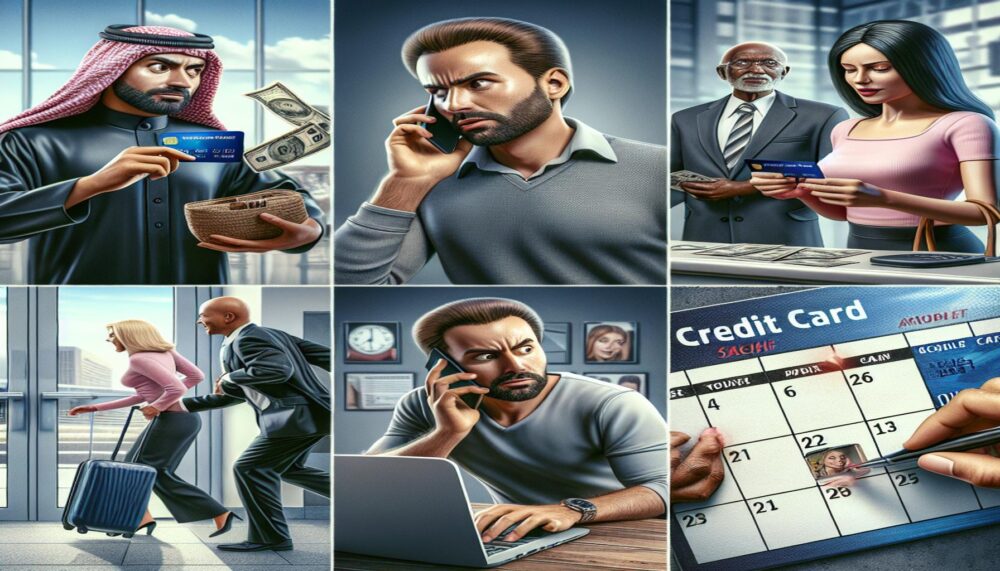

The main mistakes when using a credit card in everyday life

The Importance of Responsible Credit Card Use

Credit cards, when used correctly, can significantly enhance your financial management capabilities. They offer convenience and can help in building your credit score, which is essential for future financial endeavors like securing a loan or mortgage. However, misusing credit cards can lead to financial pitfalls that many Canadians face. It is crucial to be aware of these issues in order to navigate the credit landscape effectively.

Common Mistakes to Avoid

Understanding the common mistakes associated with credit card use can help you to avoid financial hardship. Here are some key points to consider:

- Carrying a balance: One of the most prevalent mistakes is carrying a balance month after month. When you only pay the minimum payment due, you can end up paying high interest rates on the remaining balance. For example, if you have a $2,000 balance with an interest rate of 19.99%, you could end up paying several hundred dollars in interest over a year. It’s advisable to pay off your balance in full each month to avoid these costly charges.

- Ignoring rewards: Many credit cards in Canada come with wonderful rewards programs, such as cash back, travel points, or airline miles. By not taking advantage of these benefits, you could be leaving money on the table. For instance, if you frequently shop at grocery stores and your credit card offers 2% cash back on groceries, using that card for your everyday purchases can accumulate significant rewards over time. It’s essential to educate yourself about the benefits tied to your credit card.

- Overusing credit: While it might feel tempting to use your credit card for every purchase, doing so can lead to overspending and negatively impact your credit score. A high credit utilization ratio—essentially, the amount of credit you’ve used divided by your total available credit—can signal risk to lenders. Ideally, it’s best to keep your credit utilization under 30% to maintain a healthy credit score.

Transforming Your Credit Card into an Asset

Recognizing these common pitfalls is the first step towards transforming your credit card into a beneficial financial asset rather than a liability. By adopting responsible credit card practices, you empower yourself to manage your finances more effectively. For instance, setting up automatic payments can help you avoid late fees, while budgeting can ensure that you do not overspend.

Overall, informed choices and careful management of your credit card can lead to greater financial security, saving you both stress and money in the long run. Embrace your credit card with knowledge and responsibility to unlock a world of financial opportunities.

Key Missteps in Credit Card Usage

Using a credit card can seem straightforward, but many Canadians fall into common traps that can lead to financial trouble. By understanding these mistakes, you can manage your credit card more effectively and use it to your advantage rather than allowing it to become a burden.

Failure to Monitor Spending

One significant mistake that credit card users often make is not actively monitoring their spending. Without proper tracking, it’s easy to lose sight of how much you’re charging to your card. This lack of oversight can quickly lead to overspending, creating a situation where the monthly bill exceeds your budget. To counter this, consider setting a personal limit on how much you’re willing to spend using your credit card each month. Regularly checking your statement can help you stay within these limits and make adjustments as necessary.

Ignoring Fees and Terms

Credit cards come with various fees and terms that should not be overlooked. Many cardholders neglect to read the fine print, which can lead to unexpected charges. Some common fees include:

- Annual fees: Some credit cards require an annual fee, which can range from modest to substantial. Assess whether the rewards and benefits associated with the card justify this cost.

- Foreign transaction fees: If you travel frequently, be aware that many cards charge for transactions made in foreign currencies, which can add up quickly.

- Late payment fees: Missing a payment can result in hefty penalties and an increase in your interest rate. Setting reminders or automating payments can help you avoid these fees.

By understanding the fees associated with your credit card, you can make informed choices about which card is best suited to your lifestyle and spending habits.

Not Taking Advantage of Grace Periods

Another mistake many credit card users make is failing to utilize the grace period effectively. Most credit cards offer a grace period, typically ranging from 21 to 25 days, during which you can pay your balance in full without incurring interest charges. However, some users don’t realize this and end up paying interest on purchases made shortly before the billing cycle ends. To make the most of the grace period, plan your purchases and pay off your card in full before the due date, allowing you to maximize your spending power without accruing debt.

By steering clear of these common mistakes, you can enhance your credit card experience and avoid unnecessary financial strain. Educating yourself about effective credit card practices will empower you to fully harness the benefits that come with responsible usage. Remember, a credit card can be an ally in your financial journey when managed wisely.

Additional Pitfalls to Avoid

While monitoring spending, understanding fees, and maximizing grace periods are essential steps in managing a credit card, several other common mistakes can further complicate your financial life. Being aware of these issues can help you navigate credit card use more effectively and enjoy the benefits without falling into debt.

Relying on Credit for Everyday Expenses

One frequent error that many credit card users make is relying on credit for everyday expenses. While a credit card can offer convenience, using it for regular purchases like groceries, gas, and bills can lead to a cycle of debt. Each time you swipe your card for everyday items, you may be tempted to spend more than you would if you were using cash. As a result, the balance can quickly escalate, leading to the need for higher monthly payments. To avoid this pitfall, consider using your credit card exclusively for planned purchases or emergencies, and always ensure you have the funds to cover the charges.

Overlooking Reward Opportunities

Many credit cards come with rewards programs, yet many users fail to take full advantage of them. This oversight can result in missed opportunities to earn cash back, points for travel, or discounts on future purchases. Each card has its own unique rewards structure, so it’s crucial to understand how to maximize these benefits. For example, if your card rewards grocery purchases, consider using it for those shopping trips instead of a debit card. Make a habit of tracking your spending categories and leverage any bonus offers that may enhance rewards in specific areas.

Neglecting to Pay on Time

Failing to pay your credit card bill on time is another common misstep. Late payments not only incur additional fees but can have a significant impact on your credit score, which may affect future borrowing opportunities. To mitigate this risk, establish a habit of setting reminders or utilize automatic payments for the minimum amount due each month. If you’re facing financial challenges, communicate with your credit card provider; many companies offer options like payment plans or assistance for those struggling to make payments.

Using a Single Card for Everything

Some individuals make the mistake of using one credit card for all their purchases. While this may seem simpler, it can limit the benefits you could otherwise gain from having multiple cards with different rewards or features. For example, if you frequently travel, having a credit card with no foreign transaction fees might save you money on international purchases. Conversely, another card that offers higher cash back on dining or groceries could enhance your savings in those categories. Assess your spending habits and consider diversifying your credit card portfolio for a more advantageous experience.

By being aware of these additional pitfalls, you can take proactive steps to enhance your credit card experience. Credit cards can be powerful financial tools when used responsibly, and understanding how to avoid common mistakes is essential for achieving your financial goals. Remember, informed choices pave the way for a healthier relationship with credit and long-term success.

Conclusion

In summary, navigating the world of credit cards can be complex, but understanding and avoiding common mistakes can significantly enhance your financial well-being. By recognizing the dangers of relying on credit for everyday expenses, you can prevent a troubling debt cycle. This awareness, combined with an active approach to managing rewards programs and ensuring timely payments, sets the foundation for a positive credit experience.

It is also important to remember that using multiple credit cards strategically can provide greater rewards and benefits tailored to your spending habits. For instance, if you often travel, utilizing a card that offers travel rewards or no foreign transaction fees can maximize your savings. On the other hand, using a card that provides cash back on groceries may be more advantageous for routine purchases.

Ultimately, credit cards are not just tools for borrowing; they can be gateways to financial benefits when used wisely. As a wise credit card user, you should prioritize making informed decisions, stick to your budget, and consistently monitor your expenses. Developing these habits will not only promote a healthier relationship with credit but also enable you to achieve your long-term financial goals.

So take the time to educate yourself, tailor your credit card use to your lifestyle, and you’ll find that your credit card can be a powerful ally in your financial journey.

Related posts:

How to Apply for Scotia Passport Visa Infinite Credit Card

Apply for Scotia Bank Scotia Momentum Visa Infinite Credit Card Guide

How to Apply for AMEX Marriott Bonvoy American Express Card Today

How to choose the ideal credit card for your profile

How to Apply for Amazon.ca Rewards Mastercard Easy Guide

Apply for the TD Cash Back Visa Infinite Credit Card Easy Guide

Linda Carter is a writer and financial expert specializing in personal finance and money management. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her insights on the Web Dinheiro platform. Her goal is to empower readers with practical advice and strategies for financial success.