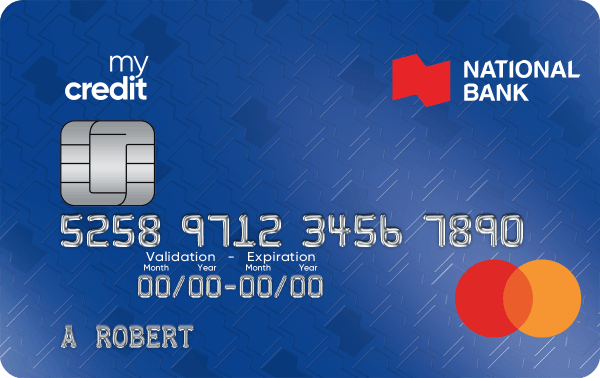

How to Apply for National Bank mycredit Mastercard Credit Card

Applying for a credit card can be daunting, but the National Bank mycredit Mastercard offers a streamlined process tailored for Canadians. As a versatile financial tool, this card is designed to meet a variety of needs, whether for everyday purchases or building a credit history. The application process is straightforward, ensuring that you can gain access to its numerous benefits swiftly.

With the mycredit Mastercard, cardholders enjoy rewarding features such as cash back on essential buys, exclusive purchase protection options, and convenient contactless payments. Designed with user-friendly terms, it caters to those seeking flexibility and simplicity. Navigating the application requires just a few key steps, providing clarity and confidence from start to finish.

This introduction highlights the tangible advantages of owning a National Bank mycredit Mastercard and aims to guide you through the application with ease, emphasizing its place in the Canadian financial landscape.

Benefits of the National Bank mycredit Mastercard

Cashback Rewards

The National Bank mycredit Mastercard offers an attractive cashback rewards program. Cardholders can earn cashback on all eligible purchases, which provides a practical way to save money while spending. Notably, there is a maximum annual cashback limit, so it is beneficial to plan high-value purchases strategically to maximize your rewards throughout the year.

Low Credit Score Requirement

One of the distinct benefits of this card is its accessibility for individuals with lower credit scores. This makes it a viable option for young adults or those looking to rebuild their credit. By using the card responsibly and making timely payments, cardholders can gradually improve their credit score, opening the door to more financial opportunities.

Zero Liability for Fraudulent Transactions

The National Bank mycredit Mastercard provides peace of mind with its zero liability policy for unauthorized transactions. If your card is lost or stolen, you can report it promptly to avoid being held liable for fraudulent charges. It’s imperative to monitor your statements regularly and take quick action if anything suspicious arises.

Affordable Annual Fees

This card comes with a lower annual fee compared to many premium credit cards in Canada, making it a budget-friendly option. When assessing the overall cost, weigh the fee against the cashback and other benefits earned over the year to ensure it aligns with your financial goals. It’s advisable to review the fee structure annually to ensure it continues to meet your needs as your financial situation evolves.

APPLY NOW FOR YOUR NATIONAL BANK MYCREDIT MASTERCARD

Requirements for the National Bank mycredit Mastercard

- Minimum Income: Applicants must demonstrate a stable financial background with a verifiable minimum personal income, typically around CAD $12,000 annually, depending on employment status. This ensures the ability to meet monthly payments successfully.

- Credit Score: A good credit history is a crucial requirement. Applicants should ideally have a credit score of 600 or higher to qualify, ensuring their capability of managing credit responsibly.

- Canadian Residency: The applicant must be a resident of Canada. Proof of residence may be required and could include government-issued identification along with a utility bill or other formal documentation.

- Age Requirement: As a fundamental criterion, applicants must be at least 18 years old, aligning with the legal age of credit eligibility in most Canadian provinces. In some areas, this minimum age requirement might be 19.

- Documentation: Prepare necessary documents such as a government-issued ID and proof of address. Additionally, applicants might need to provide employment and income verification.

CLICK HERE TO GET YOUR NATIONAL BANK MYCREDIT MASTERCARD

How to Apply for the National Bank mycredit Mastercard

Step 1: Access the National Bank Website

To begin your application process for the National Bank mycredit Mastercard, you need to visit the National Bank website. Open your preferred internet browser and enter the official URL: www.nbc.ca. Once the homepage loads, navigate to the ‘Personal Banking’ section, and select ‘Credit Cards’ from the menu. Here, you will find a list of available credit cards, including the mycredit Mastercard.

Step 2: Review the Card Details

Before proceeding with the application, it’s crucial to review the detailed features, terms, and conditions of the National Bank mycredit Mastercard. Click on the card’s name to access comprehensive information about its benefits, fees, and eligibility criteria. Make sure that this card aligns with your financial needs and credit profile before applying.

Step 3: Start the Application Process

If you decide that the National Bank mycredit Mastercard is suitable for your financial objectives, locate and click the ‘Apply Now’ button. You will be directed to the application page, where you must fill out the necessary personal and financial information. Ensure that all details provided are accurate to avoid any delays in processing your application.

Step 4: Submit Necessary Documentation

As part of the application process, you may be required to upload certain documents, such as proof of income and identification. Prepare these documents in digital format for a smooth submission process. Follow the instructions on the application page carefully to ensure all files are uploaded correctly.

Step 5: Await Application Decision

Once all sections of the application are complete and your documents are submitted, review your entries for accuracy, and then submit your application. The bank will process your request and notify you of the decision through your provided contact details. If approved, you can expect to receive your National Bank mycredit Mastercard in the mail within a few business days.

APPLY NOW FOR YOUR NATIONAL BANK MYCREDIT MASTERCARD

Frequently Asked Questions About the National Bank mycredit Mastercard

What are the primary benefits of the National Bank mycredit Mastercard?

The National Bank mycredit Mastercard offers a range of benefits, including a cash back program where cardholders earn 1% cash back on grocery and restaurant purchases and 0.5% cash back on all other purchases. Additionally, it provides purchase protection and an extended warranty on eligible items. Cardholders also benefit from the Mastercard Zero Liability, which safeguards against unauthorized transactions.

Is there an annual fee for the National Bank mycredit Mastercard?

There is no annual fee for the National Bank mycredit Mastercard, making it an attractive option for those seeking to maximize rewards without added costs. This feature also positions it as an accessible entry-level credit card for individuals looking to build or maintain their credit history in Canada.

What is the interest rate for the National Bank mycredit Mastercard?

The standard interest rate for the National Bank mycredit Mastercard is 20.99% on purchases and 22.99% on balance transfers and cash advances. It’s vital for cardholders to be aware of these rates to manage their credit responsibly and avoid unnecessary interest charges by paying off their balance in full each month.

Does the National Bank mycredit Mastercard offer any insurance coverage?

Yes, the National Bank mycredit Mastercard provides complimentary purchase insurance, which covers theft and damage for up to 90 days from the date of purchase. Furthermore, it includes an extended warranty insurance that doubles the manufacturer’s warranty period, up to an additional year. Cardholders can enjoy these protections for added peace of mind on eligible purchases.

Related posts:

How to Apply for MBNA Smart Cash World Mastercard Credit Card

How to Apply for Scotia Bank Plan Loan Easy Step-by-Step Guide

Apply for Scotia Bank Scotia Momentum Visa Infinite Credit Card Guide

How to Apply for Scotia Passport Visa Infinite Credit Card

How to Apply for the AMEX American Express Gold Rewards Card

How to Apply for AMEX American Express Business EdgeTM Card Today

Beatriz Johnson is a seasoned financial analyst and writer with a passion for simplifying the complexities of economics and finance. With over a decade of experience in the industry, she specializes in topics like personal finance, investment strategies, and global economic trends. Through her work on Web Dinheiro, Beatriz empowers readers to make informed financial decisions and stay ahead in the ever-changing economic landscape.