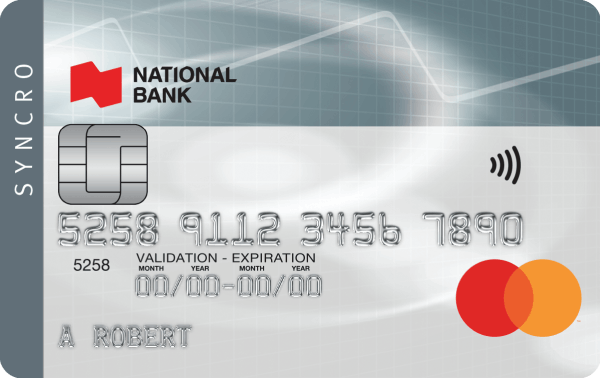

How to Apply for a National Bank Syncro Mastercard Credit Card

Embarking on the journey to acquire a reliable credit card involves numerous considerations, and the National Bank Syncro Mastercard stands out as an excellent choice for Canadians seeking flexibility and convenience. Known for its competitive interest rates directly tied to the prime rate, this credit card offers a distinct advantage for those who prioritize savings on interest costs.

Low annual fees further enhance its appeal, making it an attractive option for budget-conscious individuals. Whether you’re aiming to consolidate purchases or earn rewards, this card provides a unique blend of value and benefit. Moreover, cardholders gain access to a range of additional perks, such as comprehensive insurance coverage and practical tools for managing finances efficiently.

Understanding the application process is crucial not only for successful approval but also to leverage the full spectrum of this card’s features. Discover how to make the most of this financial tool tailored to meet diverse spending needs in Canada.

Benefits of the National Bank Syncro Mastercard

1. Competitive Interest Rates

The National Bank Syncro Mastercard offers one of the lowest interest rates among credit cards in Canada. This makes it an excellent choice for individuals who carry a balance and wish to minimize interest charges. By transferring balances from higher-interest cards to this lower-rate option, you can effectively reduce your debt over time.

2. No Annual Fee for Additional Cards

When you choose the National Bank Syncro Mastercard, you can receive additional cards for family members at no extra charge. This allows you to consolidate spending under one account, making it easier to accumulate rewards and manage expenses. Ensure each cardholder understands responsible spending to take full advantage of this benefit.

3. Purchase Protection

This card provides robust purchase protection, including extended warranty coverage and protection against theft or damage. Purchases made with the National Bank Syncro Mastercard are automatically covered, providing peace of mind and safeguarding your investments. Take the time to understand the specifics of the protection plan to ensure you are fully utilizing this benefit.

4. Travel Insurance

The National Bank Syncro Mastercard includes comprehensive travel insurance benefits, providing financial security during travel interruptions or emergencies. This includes travel accident insurance and trip cancellation protection. Familiarize yourself with policy details before traveling to ensure you can access assistance if needed.

5. Convenient Online Account Management

Manage your finances on the go with easy online accessibility. The National Bank Syncro Mastercard offers a user-friendly online platform, allowing you to track spending, pay bills, and set up alerts. Embrace digital tools to enhance financial oversight and streamline account management.

GET YOUR NATIONAL BANK SYNCRO MASTERCARD TODAY

Requirements to Apply for National Bank Syncro Mastercard

- Minimum Age Requirement: Applicants must be at least 18 years old. This ensures compliance with Canadian regulations regarding legal age for entering into agreements.

- Residential Status: You must be a Canadian resident to qualify for this card. Proof of residency may be requested during the application process.

- Credit Score: While no explicit score threshold is mentioned, a good to excellent credit score is generally recommended. Having a higher credit score can improve your chances of approval and access to better terms.

- Minimum Income: Applicants may need to demonstrate a steady source of income, with some set income requirements as proof of the ability to repay borrowed funds. Ensure to have documents such as recent pay stubs or tax assessments ready if needed.

- Identification and Documentation: Provide valid government-issued identification, such as a driver’s license or passport, along with supplementary documents like a Social Insurance Number (SIN) for identity verification.

- Existing Banking Relationship: While not mandatory, having an existing account with National Bank might benefit your application processing, potentially providing additional insights into your financial behaviors.

SIGN UP FOR YOUR NATIONAL BANK SYNCRO MASTERCARD TODAY

How to Apply for the National Bank Syncro Mastercard

Step 1: Visit the National Bank Website

Begin your application process by navigating to the official National Bank of Canada website. You can do this by entering the URL directly into your web browser or by performing a search for “National Bank of Canada” using a search engine. Once on the homepage, locate the credit cards section from the main menu, and select the Syncro Mastercard option to find specific information about this card.

Step 2: Review Card Details and Eligibility Requirements

It is crucial to understand the specific features, benefits, and terms associated with the National Bank Syncro Mastercard before proceeding with the application. Take time to carefully read about the interest rates, annual fees, and any rewards or benefits offered. Additionally, review the eligibility requirements to ensure you qualify for the card. This can include being a Canadian resident, meeting a minimum income threshold, and having a satisfactory credit score.

Step 3: Prepare Necessary Documentation

Gather all required documents needed for applying. Typically, you will need to provide personal identification like a passport or driver’s license, proof of income, such as pay stubs or tax statements, and information about your current financial situation, including details of any existing debts and assets. Having this information readily available will streamline the application process.

Step 4: Complete the Online Application

Proceed to fill out the online application form. You will be required to enter your personal, employment, and financial details. Ensure all information is accurate and complete to avoid any delays in processing. Review the terms and conditions carefully before submitting your application. Pay attention to any additional options, such as balance transfer requests, that might be available.

Step 5: Await Approval and Confirmation

After submitting your application, you will receive a confirmation message from the National Bank. The bank will review your application, and you may be contacted for further information or documentation if needed. Approval times can vary, but you will typically receive a decision within a few business days. Once approved, your National Bank Syncro Mastercard will be mailed to you along with instructions on activating the card.

REQUEST YOUR NATIONAL BANK SYNCRO MASTERCARD NOW

Frequently Asked Questions about National Bank Syncro Mastercard

What is the interest rate for the National Bank Syncro Mastercard?

The National Bank Syncro Mastercard offers a competitively low interest rate, which is designed to help cardholders manage their expenses more effectively. The interest rate is a variable rate, typically set at 4.00% above the National Bank’s prime rate. Please note that this rate may fluctuate depending on changes in the prime rate.

Are there any annual fees associated with the National Bank Syncro Mastercard?

Yes, the National Bank Syncro Mastercard has an annual fee of $35. This fee is relatively low compared to other premium cards, making it a cost-effective option for individuals prioritizing lower interest rates over additional rewards or benefits.

What benefits does the National Bank Syncro Mastercard offer?

The National Bank Syncro Mastercard primarily focuses on offering a low interest rate. Despite its low fee, it also includes benefits such as purchase protection and extended warranty coverage. Cardholders can also opt-in to receive account alerts and benefit from 24/7 customer service support from National Bank.

How does the National Bank Syncro Mastercard’s coverage protect me?

The card provides purchase protection, which covers most items purchased with the card against theft or damage for up to 90 days from the purchase date. Additionally, the extended warranty feature can double the manufacturer’s original warranty period by up to one additional year on eligible items. This provides cardholders peace of mind in case unexpected incidents occur after purchasing products.

How can I apply for the National Bank Syncro Mastercard?

Applications for the National Bank Syncro Mastercard can be completed online through the National Bank’s website, by visiting a National Bank branch, or by calling their customer service line. To be eligible, applicants typically need to meet certain income and creditworthiness criteria. It is advisable to have personal and financial information readily available when applying to streamline the process.

Related posts:

How to Apply for Scotia Bank Plan Loan Easy Step-by-Step Guide

How to Apply for the National Bank Allure Mastercard Credit Card

The main mistakes when using a credit card in everyday life

How to Apply for MBNA True Line Gold Mastercard Credit Card Online

How to Apply for the AMEX SimplyCash Card from American Express

How to Apply for the National Bank World Elite Mastercard Credit Card

Beatriz Johnson is a seasoned financial analyst and writer with a passion for simplifying the complexities of economics and finance. With over a decade of experience in the industry, she specializes in topics like personal finance, investment strategies, and global economic trends. Through her work on Web Dinheiro, Beatriz empowers readers to make informed financial decisions and stay ahead in the ever-changing economic landscape.