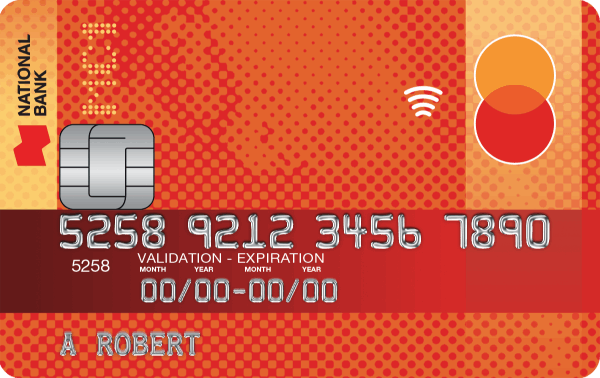

Apply for National Bank MC1 Mastercard Credit Card Step-by-Step Guide

Explore a seamless way to enhance your purchasing power with the National Bank MC1 Mastercard Credit Card, designed exclusively for Canadians seeking a straightforward credit solution with notable perks. This card offers compelling features, including no annual fees, making it an attractive option for budget-conscious individuals who prioritize smart financial management.

Whether you’re looking to build credit or enjoy the convenience of mobile payments, the MC1 Mastercard simplifies everyday transactions. With the integration of advanced security features like Zero Liability Protection, cardholders can shop confidently, knowing their finances are well-protected. Furthermore, embrace added convenience through features like contactless payments, enhancing your shopping experience.

Discover today how the National Bank MC1 Mastercard Credit Card can become an essential part of your financial toolkit. With our step-by-step application guide, embark on a journey towards financial empowerment, informed decisions, and seamless transactions. Delve deeper into its advantageous offerings and tailor them to your financial goals, ensuring a practical and reliable credit solution.

Benefits of the National Bank MC1 Mastercard Credit Card

No Annual Fee

The National Bank MC1 Mastercard Credit Card stands out by offering no annual fee. This makes it an excellent choice for individuals who wish to maximize their purchasing power without worrying about overhead costs. By eliminating annual fees, cardholders can keep their credit costs down, making it easier to manage expenses effectively throughout the year.

Competitive Interest Rates

This credit card provides highly competitive interest rates compared to many other credit card offerings. For those who may occasionally carry a balance, the MC1 Mastercard’s low-interest rate can lead to significant savings over time. To optimize this benefit, aim to pay more than the minimum balance each month, reducing the interest accrued over the credit term.

Comprehensive Purchase Protection

Cardholders are entitled to purchase protection, which covers new purchases against damage or theft. This benefit provides peace of mind by ensuring that recent acquisitions are safeguarded. To make the most out of this feature, keep all purchase receipts and documentation handy, enabling quick and efficient claims if needed.

Wide Acceptance

Accepted at millions of locations worldwide, the National Bank MC1 Mastercard provides the flexibility and security needed for both domestic and international travel. This convenience ensures you can enjoy seamless transactions, whether shopping locally or abroad. Always inform your bank beforehand about planned international travel to ensure uninterrupted use of your card.

Flexible Payment Options

The credit card also offers flexible payment options, allowing you to choose how much to pay each month according to your financial situation. This aids in managing cash flow efficiently and avoiding undue financial stress. Utilize the card’s digital banking interface to set up automatic payments and avoid late fees.

REQUEST YOUR NATIONAL BANK MC1 MASTERCARD CREDIT CARD NOW

Requirements to Apply for the National Bank MC1 Mastercard Credit Card

- Minimum Age: Applicants must be at least 18 years old to qualify for the National Bank MC1 Mastercard Credit Card. In some provinces or territories where the age of majority is higher, applicants must meet that specific minimum age requirement.

- Canadian Residency: This credit card is intended for Canadian residents. Applicants must provide proof of residency, such as a government-issued ID or utility bill, to verify that they live in Canada.

- Credit Score: While the National Bank MC1 Mastercard targets a broad audience, maintaining a good credit score (generally above 650) increases the chances of approval. It is advisable for applicants to have a credit history that demonstrates responsible credit management.

- Income Verification: Applicants must present proof of a consistent source of income. Although there is no strict minimum income requirement, having a stable income reassures the bank of the applicant’s capacity to manage credit card obligations.

- Documentation: Required documents typically include recent pay stubs, bank statements, or tax returns to facilitate a smooth application process. Possessing these documents in advance can expedite the approval process.

REQUEST YOUR NATIONAL BANK MC1 MASTERCARD CREDIT CARD NOW

Step-by-Step Guide to Apply for the National Bank MC1 Mastercard Credit Card

Step 1: Visit the National Bank’s Website

To begin the application process for the National Bank MC1 Mastercard Credit Card, you will need to access the official National Bank of Canada website. Use a reliable browser and type in the web address: www.nbc.ca. Once there, navigate to the ‘Personal’ section and locate the ‘Mastercard Credit Cards’ category. This section contains detailed information on various credit card options.

Step 2: Explore the MC1 Mastercard Features

Once you’ve found the right section, look for the MC1 Mastercard and review its features. The website will provide comprehensive details such as credit limits, interest rates, and any applicable fees or rewards. Understanding these features will assist you in making an informed decision about whether this card is suitable for your financial needs.

Step 3: Prepare for the Application

Prior to starting the application, ensure you have all necessary documents ready. This typically includes a government-issued ID, your Social Insurance Number (SIN), and proof of income. Having this information at hand will help you complete the application smoothly and without interruptions.

Step 4: Complete the Online Application

Once prepared, proceed to fill out the online application form for the MC1 Mastercard Credit Card. You will be required to input personal information, financial details, and current employment information. Fill in these details accurately to avoid any delays in processing your application.

Step 5: Submit the Application and Await Approval

After completing the form, carefully review your information for accuracy and submit the application. The bank will evaluate your application and usually provide a response within a few business days. Upon approval, you will receive your new credit card by mail at the address provided.

CLICK HERE TO GET YOUR NATIONAL BANK MC1 MASTERCARD CREDIT CARD

Frequently Asked Questions about the National Bank MC1 Mastercard Credit Card

What are the key features of the National Bank MC1 Mastercard Credit Card?

The National Bank MC1 Mastercard Credit Card is designed to offer simple, straightforward features. It provides a credit limit that helps manage daily expenses while offering a competitive interest rate. This card does not have an annual fee, making it an affordable option for those seeking basic credit card services without additional charges. Additionally, cardholders can benefit from the ease of worldwide acceptance at vendors that support Mastercard.

Are there any rewards or cashback options available with this card?

Unlike premium credit cards, the National Bank MC1 Mastercard does not include rewards or cashback programs. This card focuses on providing a no-frills experience, ideal for individuals prioritizing financial flexibility over reward points or cashback benefits. If you are looking for rewards, you may want to consider other credit card options that offer such features.

What is the eligibility requirement for applying for the National Bank MC1 Mastercard?

To be eligible for the National Bank MC1 Mastercard, applicants must meet certain criteria. Prospective cardholders must be residents of Canada, be of the age of majority in their province or territory, and have a satisfactory credit score. Furthermore, applicants should have a stable source of income to demonstrate their ability to manage credit responsibilities effectively.

How can I manage my account and transactions with the National Bank MC1 Mastercard?

National Bank provides a robust mobile and online banking platform that allows MC1 Mastercard holders to manage their accounts efficiently. You can view current balances, review transaction history, and make payments through these digital channels. This accessibility ensures that you can keep track of your finances conveniently, anytime and anywhere.

What should I do if my National Bank MC1 Mastercard is lost or stolen?

In the event that your MC1 Mastercard is lost or stolen, it is crucial to act promptly. Contact National Bank’s customer service immediately to report the incident and prevent unauthorized transactions. The bank’s representatives will assist in deactivating your current card and issuing a replacement as swiftly as possible. Additionally, staying vigilant and regularly checking your statement can help you detect any unauthorized activity early.

Related posts:

How to Apply for National Bank ECHO Cashback Mastercard Credit Card

How to Renegotiate Overdue Credit Card Bills

How to Apply for AMEX Marriott Bonvoy American Express Card Today

How to Apply for a National Bank Syncro Mastercard Credit Card

How to Apply for AMEX American Express Business EdgeTM Card Today

How to Apply for AMEX American Express Green Card A Step-by-Step Guide

Beatriz Johnson is a seasoned financial analyst and writer with a passion for simplifying the complexities of economics and finance. With over a decade of experience in the industry, she specializes in topics like personal finance, investment strategies, and global economic trends. Through her work on Web Dinheiro, Beatriz empowers readers to make informed financial decisions and stay ahead in the ever-changing economic landscape.