How to save money every day with minimalist habits

Understanding Minimalism in Daily Life

In an age where consumerism often leads to financial strain, adopting minimalist habits presents a refreshing approach to not just spending but also enhancing overall well-being. Embracing minimalism means taking a step back to reflect on what truly matters, allowing you to make intentional decisions that contribute significantly to your finances. This practice encourages you to declutter both your physical space and your mind, which can lead to a more fulfilling and financially sound lifestyle.

Mindful Spending

At the core of minimalism is mindful spending. This concept revolves around the idea of purchasing only what you genuinely need rather than succumbing to the allure of fleeting desires. For instance, instead of buying the latest smartphone model simply because it’s trendy, consider whether your current phone meets your needs. This pause for reflection can prevent impulse purchases that often lead to a drained wallet.

Reducing Clutter

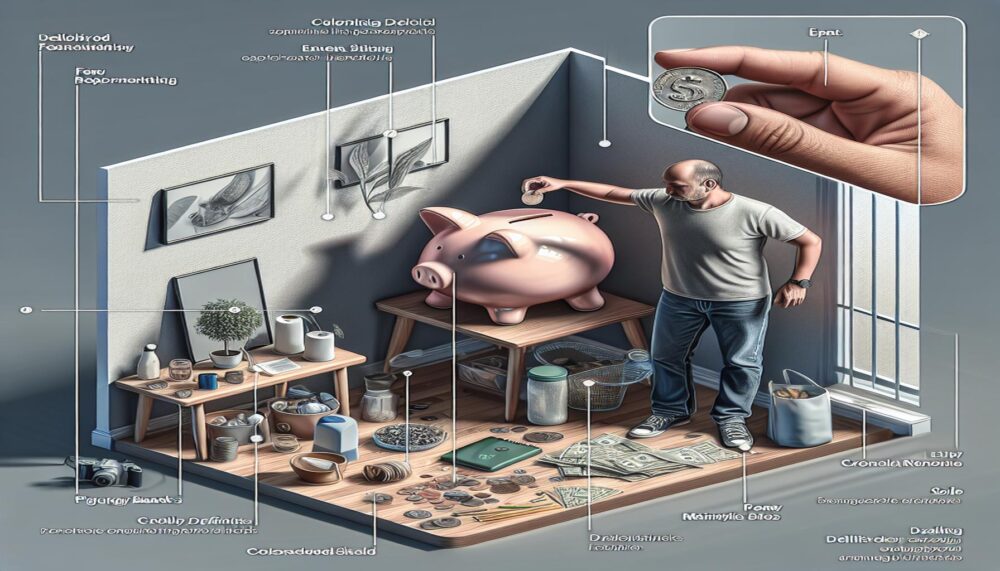

One of the often-overlooked benefits of minimalism is the opportunity to reduce clutter and, in turn, generate some additional income. Take a weekend to go through your belongings and identify items you no longer use—clothes, electronics, or household items. In Canada, platforms like Kijiji or Facebook Marketplace make it easy to sell these items. Not only does this clear up space, but it also puts some money back in your pocket!

Quality Over Quantity

Minimalism advocates for quality over quantity. Investing in fewer, high-quality items can lead to long-term savings. For example, rather than buying multiple cheap pairs of shoes that wear out quickly, consider spending a bit more on a single well-made pair that will last for years. This not only reduces waste but can also save you money in the long run as you won’t have to replace items frequently.

Practical Steps to Embrace Minimalism

Plan Meals

One practical strategy to save money is to plan meals effectively. Create a weekly menu that outlines what you will eat for breakfast, lunch, and dinner. This meal planning can help you make precise grocery lists, reducing impulse purchases at the store. By focusing only on the ingredients you need, you can significantly cut down on unnecessary expenses while also eating healthier.

Limit Subscriptions

In today’s digital age, many Canadians find themselves subscribed to various streaming services, magazines, or apps. It’s beneficial to regularly review these monthly expenses and limit subscriptions. Identify services you rarely use and consider cancelling them. This simple exercise can free up a substantial amount of money each month.

Utilize Public Transport

Lastly, consider using public transport instead of driving your car every day. Not only does this save on gas, insurance, and parking fees, but it also contributes to a reduction in your carbon footprint. Whether it’s taking the bus or using the subway, public transport can often be a more economical and environmentally friendly way to navigate your city.

By integrating these simple yet impactful practices into your daily routine, you can experience significant shifts in your financial landscape. Embracing a minimalist lifestyle helps you prioritize what is essential, allowing you to live more intentionally while saving money each step of the way.

Adopting Minimalist Mindsets

As you explore minimalism, it’s critical to adopt specific mindsets that help reinforce your commitment to saving money. One of the most impactful attitudes you can develop is the acceptance of “enough.” Understanding that you already have enough in your life can greatly change your perspective on spending. For example, instead of continuously seeking out the latest fashion trends, focus on curating a wardrobe with versatile, timeless clothing that serves multiple purposes. This approach encourages you to appreciate what you have and reduces the desire to acquire more.

Learning to Say No

Another aspect of embracing a minimalist lifestyle is the ability to say no—to yourself and to others. It can be tempting to accept every social invitation or to indulge in every new sale at your favorite store. By setting boundaries, you cultivate a mindset that prioritizes your financial goals. For instance, when a friend invites you out for a pricey dinner, consider suggesting a potluck instead. You get to enjoy time with friends while avoiding the high costs associated with dining out.

Finding Free or Low-Cost Alternatives

Minimalism encourages you to find free or low-cost alternatives to everyday activities. This can be both an enjoyable and creative process. Here are a few ideas to get you started:

- Explore local parks and trails for your daily exercise rather than an expensive gym membership.

- Take advantage of community events, fairs, or workshops that often come at little to no cost.

- Engage in free online courses to learn new skills instead of paying for expensive classes.

By adopting this approach, you not only save money but also foster a deeper connection with your community and environment.

Mindful Home Management

Minimalism also extends to how you manage your home. By being more intentional with your home organization, you can decrease unnecessary spending. For example, use what you already have at home to develop creative solutions instead of making a trip to the store for more items. This could mean repurposing an old jar for storage or rearranging your furniture to create a refreshed space without buying new things. Such practices allow you to save money while also promoting sustainability.

In adopting these mindsets and habits, you’ll start to notice a positive impact on your finances and overall quality of life. Rather than high expenditures that come with a cluttered mindset, minimalism offers a chance to transform your daily experiences into rich, fulfilling moments that don’t require excessive spending.

Streamlining Your Spending

Once you have adopted a minimalist mindset, the next step is to focus on streamlining your spending. This involves reevaluating your expenses to identify areas where you can cut costs. Start by reviewing your monthly bills and subscriptions. Are you still using that streaming service you signed up for on a whim? Or do you have multiple subscriptions for similar services? Consolidating or eliminating redundant services can lead to immediate savings.

Creating a Budget That Reflects Your Values

Another practical way to reduce spending is by creating a budget that aligns with your minimalist values. Divide your expenses into two categories: must-haves and nice-to-haves. Must-haves include essential needs like housing, groceries, and transportation, while nice-to-haves might include dining out, entertainment, and luxury purchases. By clearly distinguishing between these categories, you can allocate funds more effectively, allowing you to enjoy the things that truly matter to you without overspending.

Practicing Delayed Gratification

In today’s fast-paced world, it’s all too easy to give in to impulse buying. A key tenet of minimalism is practicing delayed gratification. This means putting off a purchase for a set amount of time—like a week or a month. This period allows you to determine whether the item is truly necessary or simply a fleeting desire. For instance, if you feel the urge to buy a new gadget, wait a couple of weeks. After some reflection, you might realize that you don’t actually need it after all, thus saving yourself the expense.

Finding Joy in Simplicity

Minimalism is not just about cutting back; it’s also about finding joy in simplicity. Rather than filling your life with material possessions, focus on experiences that enrich your life. Opt for low-cost activities that foster connections and personal growth. For example, host a game night using the board games you already own, or gather friends for a free movie night at home instead of hitting the theater. These alternatives not only save money but also create treasured memories that far outweigh the temporary satisfaction of material purchases.

Learning to Repair and Repurpose

Finally, embrace a repair and repurpose mentality. Instead of tossing out broken items, consider fixing them. YouTube is an invaluable resource for tutorials on repairing everything from electronics to clothing. Additionally, think creatively about how to repurpose items you may no longer use. For instance, an old ladder could become a bookshelf, or jars can serve as unique storage solutions. This practice not only helps reduce waste but also saves you the money that would have been spent replacing these items.

By streamlining your spending through these practical strategies, you position yourself for financial sustainability while enriching your life with experiences that resonate with your minimalist values. Each step you take moves you closer to a lifestyle of intentional spending, demonstrating that less can indeed lead to more—more happiness, more fulfillment, and ultimately, more financial freedom.

Embracing a Minimalist Approach to Financial Freedom

As we conclude our discussion on saving money through minimalist habits, it’s essential to recognize that adopting a simpler lifestyle is not merely about spending less; it’s about living intentionally and prioritizing what truly matters to you. By applying the principles of minimalism, you can identify unnecessary expenses, focus on experiences over possessions, and cultivate a sense of gratitude for what you already have. This shift in perspective can lead to significant financial savings while enriching your life.

Implementing strategies such as creating a values-based budget, practicing delayed gratification, and finding joy in simplicity allows you to gain control over your finances. Each choice you make—whether it’s choosing a free community event over an expensive outing or taking the time to repair rather than replace—contributes to a more sustainable financial future. Embracing the repair and repurpose mindset not only saves money but also promotes creativity and reduces waste, leading to a positive impact on the environment.

Ultimately, minimalism encourages a holistic view of wealth that transcends monetary value. It invites you to invest in meaningful experiences and relationships, which often bring greater fulfillment than material possessions. By focusing on what adds value to your life, you pave the way for enhanced financial stability, personal growth, and genuine happiness. As you embark on this journey, remember that every small step contributes to a larger transformation—demonstrating that, with minimalist habits, fewer possessions can lead to richer lives.

Linda Carter is a writer and financial expert specializing in personal finance and money management. With extensive experience helping individuals achieve financial stability and make informed decisions, Linda shares her insights on the Web Dinheiro platform. Her goal is to empower readers with practical advice and strategies for financial success.